The Investment Potential of Buying Gold And Silver Coins

- написал: DarnellStedm

- 0

- 0

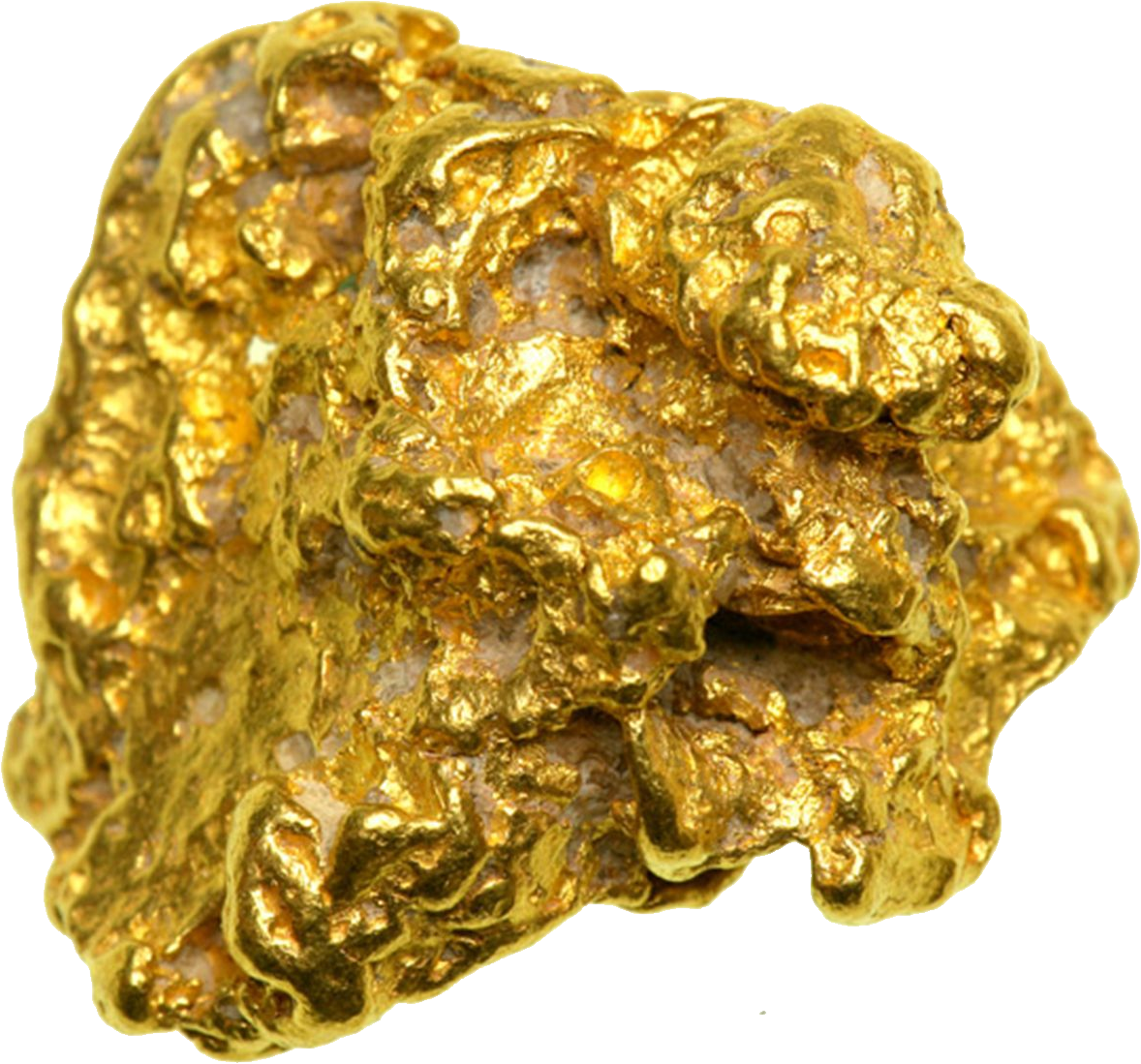

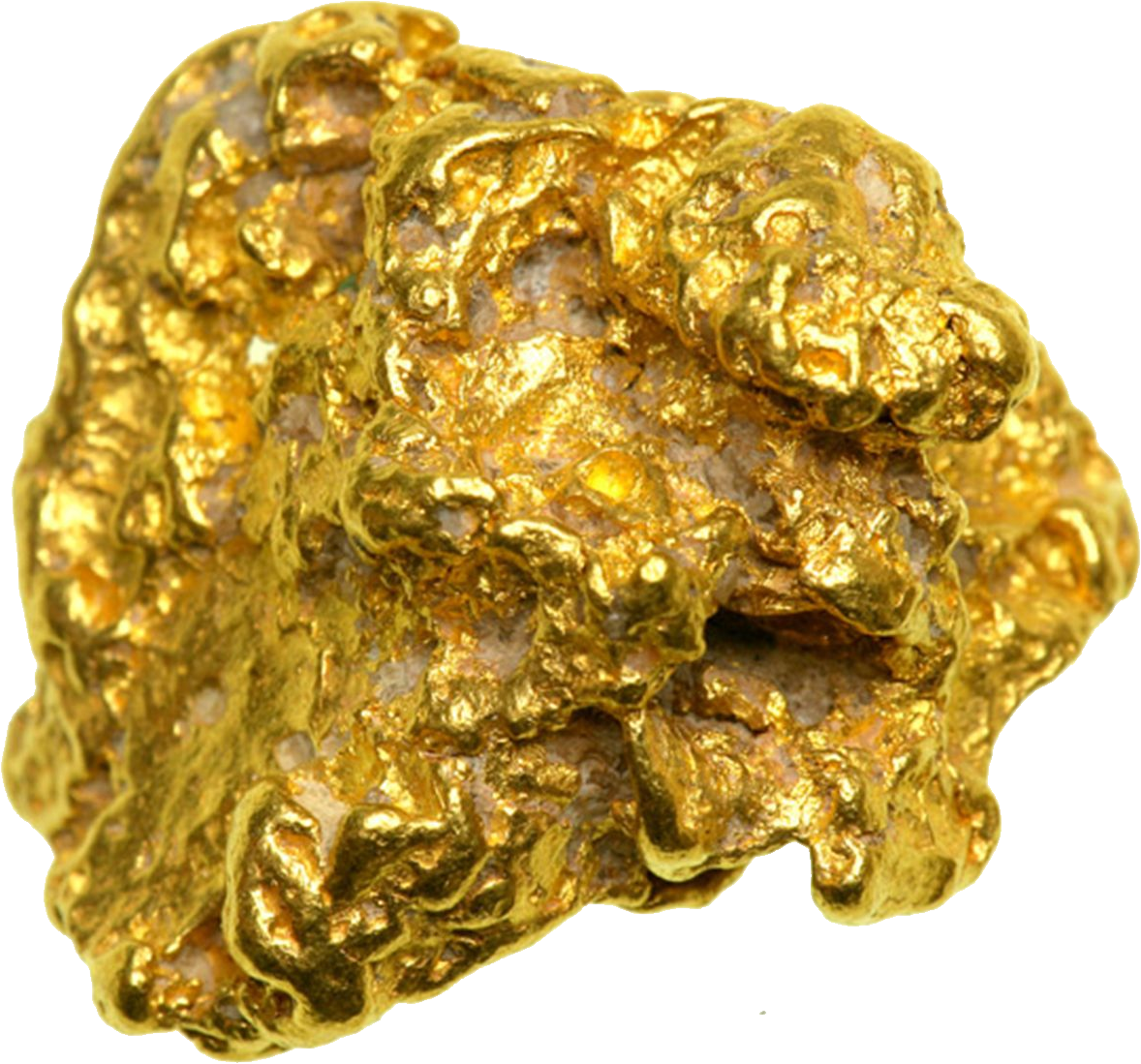

In the realm of funding opportunities, gold and silver coins have emerged as significant belongings, appealing to both seasoned investors and novices alike. Their intrinsic worth, historic significance, and position as a hedge against economic uncertainty make them attractive choices for diversifying one’s portfolio. This article explores the benefits, risks, and concerns associated with purchasing gold and silver coins as an investment.

Historic Context

Gold and silver have been used as currency and a retailer of worth for 1000's of years. Ancient civilizations acknowledged the worth of those precious metals, utilizing them for trade, jewelry, and buy gold and silver as a logo of wealth. The trendy era has seen gold and silver coins minted by numerous governments, often that includes iconic designs that reflect nationwide heritage and values. These coins not only function a medium of alternate but also hold numismatic value, which can admire over time.

Why Invest in Gold and Silver Coins?

Whereas investing in gold and silver coins presents quite a few benefits, it is crucial to consider the related dangers:

Investing in gold and silver coins is usually a rewarding endeavor for these in search of to diversify their portfolios and protect their wealth in opposition to financial uncertainty. While the advantages are substantial, potential buyers should additionally be aware of the risks and challenges involved. By conducting thorough research, selecting respected dealers, and staying knowledgeable about market situations, buyers can navigate the world of treasured metals with confidence. As with any funding, a nicely-knowledgeable method will improve the chance of attaining favorable outcomes within the dynamic panorama of gold and silver coin investments.

Historic Context

Gold and silver have been used as currency and a retailer of worth for 1000's of years. Ancient civilizations acknowledged the worth of those precious metals, utilizing them for trade, jewelry, and buy gold and silver as a logo of wealth. The trendy era has seen gold and silver coins minted by numerous governments, often that includes iconic designs that reflect nationwide heritage and values. These coins not only function a medium of alternate but also hold numismatic value, which can admire over time.

Why Invest in Gold and Silver Coins?

- Hedge Against Inflation: One among the primary causes buyers turn to gold and silver is their potential to act as a hedge against inflation. When fiat currencies lose worth attributable to inflationary pressures, valuable metals often retain their purchasing power. Historically, during durations of economic downturn, gold and silver costs are inclined to rise, buy gold and silver making them a protected haven for buyers.

- Tangible Belongings: Unlike stocks or bonds, gold and silver coins are tangible property that can be held bodily. This bodily possession supplies a sense of safety, especially during instances of financial instability or geopolitical tensions. For those who have any kind of inquiries concerning where by in addition to tips on how to utilize buy gold and silver, you are able to e-mail us on the web-site. Traders can retailer their coins in safes or security deposit packing containers, making certain they've direct access to their wealth.

- Portfolio Diversification: Together with gold and silver coins in an investment portfolio can improve diversification. Valuable metals sometimes exhibit low correlation with conventional asset classes, corresponding to stocks and bonds. This diversification will help mitigate threat and improve general portfolio efficiency, significantly throughout market volatility.

- Liquidity: Gold and silver coins are highly liquid property. They are often simply purchased and offered in numerous markets worldwide. Traders can convert their coins into money relatively quickly, making them a sensible selection for those who may have immediate entry to funds.

- Numismatic Value: In addition to their intrinsic metallic value, many gold and silver coins possess numismatic worth due to their rarity, historic significance, or situation. Collectors typically search out specific coins, which may drive up their market worth past simply the worth of the steel they contain. This potential for appreciation can provide additional returns for traders.

Whereas investing in gold and silver coins presents quite a few benefits, it is crucial to consider the related dangers:

- Market Volatility: The prices of gold and silver could be volatile, influenced by numerous components akin to geopolitical events, adjustments in interest rates, and fluctuations in forex values. Investors should be prepared for value swings and keep away from making impulsive selections based on short-term market movements.

- Storage and Safety: Physical coins require secure storage to stop theft or loss. Traders should consider the prices related to safe storage options, reminiscent of safes or security deposit packing containers, which may impact general returns.

- Premiums and Fees: When purchasing gold and silver coins, investors often pay a premium over the spot worth of the metal. This premium can range based on the coin’s rarity, demand, and condition. Additionally, selling coins may incur transaction charges, which may have an effect on profitability.

- Potential for Counterfeits: The market for gold and silver coins will not be immune to counterfeit merchandise. Traders must exercise due diligence when purchasing coins, making certain they buy from reputable dealers and verifying the authenticity of the coins.

- Regulatory Considerations: Totally different countries have varying regulations relating to the buying, selling, and ownership of precious metals. Investors should familiarize themselves with local legal guidelines and tax implications related to their investments.

- Research and Training: Earlier than making any purchases, it's essential to coach oneself about the several types of gold and silver coins out there. Understanding the distinctions between bullion coins, numismatic coins, and varied mints can help traders make informed choices.

- Choose Reputable Dealers: Buying coins from respected dealers is important to ensure authenticity and fair pricing. Traders should seek out dealers with positive critiques, business certifications, and clear business practices.

- Consider Coin Sorts: Traders can choose from a variety of coins, together with government-minted bullion coins (such as the American Gold Eagle or Canadian Silver Maple Leaf) and collectible numismatic coins. Each kind has its advantages and potential dangers, so it is crucial to align purchases with funding targets.

- Monitor Market Situations: Keeping a watch on market trends, economic indicators, and geopolitical occasions will help investors time their purchases extra successfully. Shopping for during dips in the market might lead to higher long-term returns.

- Safe Storage Options: After buying coins, investors should consider their storage options. Whether choosing a secure at home, a security deposit field at a financial institution, or an expert storage facility, guaranteeing the coins are safe is paramount.

Investing in gold and silver coins is usually a rewarding endeavor for these in search of to diversify their portfolios and protect their wealth in opposition to financial uncertainty. While the advantages are substantial, potential buyers should additionally be aware of the risks and challenges involved. By conducting thorough research, selecting respected dealers, and staying knowledgeable about market situations, buyers can navigate the world of treasured metals with confidence. As with any funding, a nicely-knowledgeable method will improve the chance of attaining favorable outcomes within the dynamic panorama of gold and silver coin investments.

0 комментариев